AREION ASSETS MANAGEMENT PRIVATE LIMITED

Focused Funds. Proven Asset Growth.

Resolving India’s Stressed Assets: Decade-Strong Expertise, Pan-India Reach.

About us

Areion Asset Management

Areion Asset Management Company (AAMC), the investment management arm of the Areion Group, stands at the forefront of distressed financial services. Promoted by seasoned professionals with deep expertise in Special Situations, Stressed Loan Management, and Turnaround Specialisation, AAMC is uniquely positioned to deliver value creation and recovery in complex financial scenarios. With a proven track record and a solutions-driven approach, the company provides end-to-end services to Corporates, Banks, NBFCs, and ARCs, empowering institutions to overcome challenges, unlock opportunities, and achieve sustainable financial outcomes.

Indian Market Stress Overview

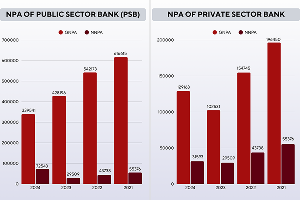

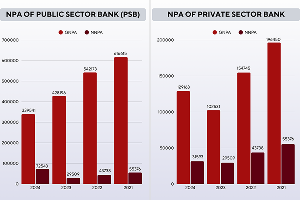

NPA IN BANKING SECTOR

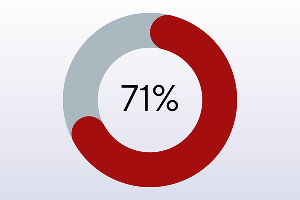

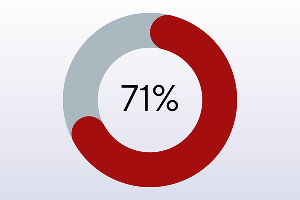

STRESSED ASSET CONCENTRATION WITH PSBS

STRESSED ASSET CONCENTRATION WITH PSBS

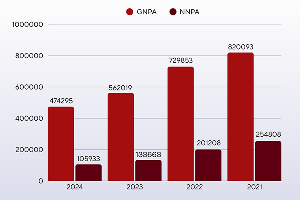

CONSOLIDATED NPA OF INDIAN BANKS

STRESSED ASSET CONCENTRATION WITH PSBS

STRESSED ASSET CONCENTRATION WITH PSBS

Find your investment opportunities

- Stressed assets challenge has grown with a total Net NPA of INR 105 thousand crore in March 2024.

- Public sector banks (PSB) continue to face challenges such as the need for further capital infusion, improving governance and risk management practices, etc.

- Private sector Banks faces challenges such as increasing competition, the need to expand their presence in rural & semi-urban areas and managing regulatory risks.

Areion Group Overview

Areion Assets Management Private Limited

Investment Manager of SEBI Registered Category I and Category II AIF.

Areion Finserve Private Limited

A non-systemically, non-deposit taking important NBFC, registered under Section 45IA of The RBI Act, 1934.

ACAIPL Investment and Financial Services Private Limited

Financial Advisor and Investment firm specialist in Special Situation.

Areion Fincap Private Limited

Team provides financial advisory both buy and sell side in special situation category.

Areion Credittech Private Limited

Areion Credittech provides customer service and collection services to the organization.

Omkara Asset Reconstruction Private Limite

Omkara ARC specializes in acquiring and resolving distressed assets to aid in financial recovery and asset reconstruction

Opportunities

Business Products

The following points outline our core business offerings, designed to address complex financial situations and unlock value across distressed and high potential assets. Our product suite reflects a strategic approach to capital deployment in turnaround opportunities.

clients

Recoverables and Redemption proceeds

Fund Structure & Charges

Fund Structure & Charges

Recovery Rate / NAV Distribution

At 24% Recovery

At 36% Recovery

Above 36% Recovery

contact

Let's get started

Contact us for more information, fund documents and other pertinent information.

Contact us for more information, fund documents and other pertinent information.

Send us an email

info.amc@areion.in

Talk to us

022-6923 1222

Corporate Office

Kohinoor Square, 47th floor, N.C

Kelkar Marg, R.G. Gadkari Chowk,

Dadar (West), Mumbai – 400028.

Registered Address

D/511, Kanakia Zillion,

Junction of LBS Road and CST

Road, BKC Annexe, Kurla (West),

Mumbai – 400070.

Areion Group

- Areion Fincap Private Limited

- ACAIPL Investment and Financial Services Private Limited

- Areion Real Estate Services Private Limited

- Areion Finserve Private Limited

- Areion Credittech Private Limited